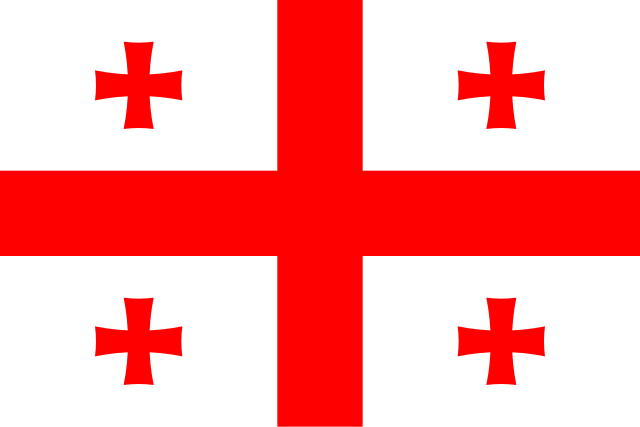

Looking to operate a Forex business in Georgia? Here's what you need to know:

The Georgia Forex license, introduced by the National Bank of Georgia (NBG) on 11 April 2018, offers a fast-track licensing process (just one month) and a business-friendly regulatory framework. With low taxes, simplified compliance, and access to the European market, Georgia has become a popular destination for Forex operators.

Key Highlights:

- Capital Requirements: Minimum 500,000 GEL (≈ $200,000) for a standard license; 100,000 GEL (≈ $40,000) for Free Economic Zone (FEZ) operations.

- Taxes: 5% profit tax and exemptions on payroll and dividend taxes.

- Processing Time: Licenses are issued within 30 days once all documents are submitted.

-

Requirements:

- Local office and staff, including an AML officer and certified Georgian accountant.

- Compliance with AML/KYC procedures.

- Reliable trading platform.

-

Costs:

- Registration Fee: 5,000 GEL (≈ $2,000).

- Annual License Fee: 15,000 GEL.

- Office Lease: Minimum 6,250 GEL/year (≈ $2,500).

License Types:

- Full Forex Broker: Broad trading rights (Forex, CFDs, derivatives) with a 500,000 GEL capital requirement.

- Dealer Operations: Proprietary trading with lower capital needs.

- Brokerage License: Focused on client order execution and portfolio management.

Pros and Cons:

Benefits:

- Low taxes and fees.

- Access to a population of 3.7 million, with increasing engagement in digital finance and trading.

- Advanced digital infrastructure.

Challenges:

- High initial capital requirements.

- Mandatory local presence and staffing.

- Strict compliance and reporting obligations.

Georgia’s Forex license offers a streamlined entry process and favorable tax conditions for businesses prepared to meet regulatory obligations. However, operators must be prepared to meet regulatory standards and maintain transparency to thrive in this market.

License Requirements

The National Bank of Georgia (NBG) outlines specific criteria for obtaining a Forex license.

Capital Requirements

The minimum paid-up capital for a standard Forex license is 500,000 GEL (around $200,000). However, for operations in a Free Economic Zone (FEZ) that cater exclusively to external clients, the required capital is reduced to 100,000 GEL (approximately $40,000).

| Capital Requirement Type | Amount Required | Notes |

|---|---|---|

| Standard License | 500,000 GEL | Full domestic operations |

| FEZ License | 100,000 GEL | Operations for external clients only |

Meeting the capital requirement is just the starting point. Compliance also depends on establishing a local presence and adhering to operational criteria.

Office and Staff Requirements

To comply with NBG regulations, Forex license applicants must establish a local office and employ qualified personnel. The key requirements include:

- A local office with an annual lease cost of at least 6,250 GEL (about $2,500).

- An AML officer (Anti-Money Laundering officer) who is a Georgian resident.

- A certified Georgian accountant responsible for financial reporting.

- A management team with proven experience in the financial sector.

These measures ensure that licensed entities maintain a robust local presence and adhere to regulatory standards.

Required Documents

Applicants must submit a comprehensive set of documents to demonstrate compliance and readiness. These are grouped into three main categories:

-

Corporate Documentation

- Articles of incorporation

- Business registration extract

- Detailed business plan

-

Personnel Documentation

- Proof of education and experience for key staff

- Criminal record clearance

- Confirmation that personnel have no prior disqualifications from financial authorities

-

Financial Documentation

- Financial statements for the past six months

- Audited annual or semi-annual reports

- Evidence of capital sources

- Verification of minimum equity

The NBG may request additional documents during the review process. All financial reports must comply with Georgian accounting standards and be submitted in the Georgian language. These strict documentation requirements reflect the NBG's commitment to maintaining a well-regulated financial environment.

Pros and Cons

The Georgia Forex license comes with a mix of advantages and challenges that businesses need to weigh carefully before diving into this regulatory pathway.

Benefits

There are several appealing aspects to obtaining a Forex license in Georgia, especially for financial companies:

Tax and Financial Perks

- A 5% profit tax rate paired with exemptions on payroll and dividend taxes.

- Banking fees are competitive, and there’s no obligation for minimum balances.

Strategic Market Opportunities

- Access to a potential 3.7 million traders within Georgia.

- Gateway to both European and Eurasian markets.

- A visa-free regime for citizens of over 90 countries, allowing stays of up to one year.

| Operational Advantage | Details |

|---|---|

| Fast Licensing | Licenses are processed within one month. |

| Remote-Friendly | Digital systems for tax submissions and reporting. |

| Advanced Infrastructure | Equipped with modern technology systems. |

| Privacy Assurance | Strong data protection laws in place. |

Limitations

Despite the benefits, there are some notable hurdles businesses must consider:

Financial Challenges

- High initial capital requirements and registration fees can be a significant barrier to entry.

- Ongoing operational costs tied to maintaining a local presence can add up over time.

Operational Demands

- A physical office in Georgia is mandatory.

- Companies must ensure a local representative is present for at least 16 days each month.

- Hiring qualified local staff is a regulatory requirement.

Regulatory Obligations

- Businesses must navigate stringent regulatory protocols.

- Regular reporting to the National Bank of Georgia is mandatory.

- Non-compliance risks license revocation, which can severely impact operations.

Georgia’s combination of low taxes, strategic location, and modern infrastructure makes it an appealing choice for Forex businesses. However, the operational and compliance requirements demand thorough planning and a solid understanding of the local regulatory landscape.

Application Steps

Securing a Forex license in Georgia involves a series of essential steps, each designed to ensure compliance with local regulations and readiness for operations.

Business Setup

Company Formation

To start, you’ll need to officially establish your business. This includes:

- Registering your LLC or JSC with the National Agency for State Registration.

- Obtaining an Individual Identification Number (IIN).

- Completing the necessary tax registration processes.

Once your company is registered, focus on building the required infrastructure to meet regulatory standards.

Banking Requirements

Open a corporate bank account to demonstrate your financial stability and commitment to operating within Georgia.

Physical Presence

Secure an office space that aligns with the regulatory standards previously outlined for Forex operations.

License Submission

After setting up your business, the next step is submitting your application to the National Bank of Georgia (NBG). This requires preparing a comprehensive set of documents:

| Required Documents | Purpose |

|---|---|

| Corporate Documents | Articles of Association and registration certificates. |

| Financial Records | Financial statements covering the last six months. |

| Personnel Documentation | Proof of specialized education for key staff members. |

| Compliance Documents | Criminal record checks and verification of capital sources. |

| Business Plan | A detailed strategy outlining operations and risk management. |

The application process includes a fee of 5,000 GEL (approximately 2,000 USD).

Post-License Requirements

Once licensed, your responsibilities don’t end there. To maintain compliance, you’ll need to:

- Submit regular reports to the NBG and Georgia's Revenue Service.

- Keep detailed financial records.

- Implement rigorous AML (Anti-Money Laundering) and KYC (Know Your Customer) measures.

- Conduct compliance training for your staff.

- Monitor transactions closely and report any irregularities promptly.

The NBG employs a risk-based approach to conduct both on-site and off-site inspections, ensuring your operations remain compliant.

License Types

Businesses have the flexibility to select a license type that best suits their operational goals and financial setup. The National Bank of Georgia (NBG) provides three distinct trading license options, each catering to different business needs:

| License Type | Capital Requirement | Features | Permitted Activities |

|---|---|---|---|

| Full Forex Broker | 500,000 GEL | Broad trading rights | Forex trading, CFDs, and derivatives |

| Dealer Operations | Below 500,000 GEL | Limited to own-account trades | Proprietary trading only |

| Brokerage License | 500,000 GEL | Intermediary services | Client order execution and portfolio management |

These licenses are structured to align with various business models, allowing companies to meet both their strategic goals and regulatory obligations.

Full Forex Broker License

This license provides the most extensive trading rights, enabling firms to engage in forex trading, CFDs, and other derivatives. To comply with NBG's standards, license holders must implement strong internal controls and risk management systems. The high capital requirement reflects the wide range of activities allowed under this license.

Dealer Operations License

Focusing on proprietary trading, this license is tailored for businesses that trade exclusively on their own account. While the capital requirement is lower compared to the Full Forex Broker License, companies must still employ skilled management and technical personnel to maintain effective risk oversight.

Brokerage License

The Brokerage License is designed for intermediaries who execute trades and manage portfolios on behalf of clients, rather than trading on their own account. Although the capital requirement mirrors that of the Full Forex Broker License, the focus here is on providing reliable client services and efficient trade execution.

Costs and Timing

Fees

Securing a Forex license in Georgia involves several financial commitments. Here's a breakdown of the key costs:

| Fee Type | Amount | Notes |

|---|---|---|

| License Registration | 5,000 GEL | Mandatory state fee |

| Company Registration | 2,500–5,000 GEL | Depends on the company structure |

| Legal Services | ~37,500 GEL | Covers documentation and compliance |

| Annual License Fee | 15,000 GEL | Recurring cost |

| Office Lease | ~6,250 GEL/year | Minimum requirement for physical space |

For details about capital requirements, refer to the "Capital Requirements" section earlier in this guide.

Processing Time

After covering the required fees, the licensing process follows a defined timeline:

| Phase | Duration | Milestones |

|---|---|---|

| Preparation | 1–3 months | Legal registration and business setup |

| Documentation | 1 month | Filing applications and paying fees |

| NBG Review | 1–3 months | Verification and compliance checks |

| License Issuance | Up to 1 month | Final approval and license issuance |

The National Bank of Georgia (NBG) typically processes complete applications within 30 days. However, the end-to-end process - from initial preparation to receiving the license - can take up to six months. This depends on factors like the complexity of the application and the completeness of submitted documentation.

Key points to note:

- The NBG review period begins only after all required documents are submitted.

- Delays may occur if additional information or clarifications are requested.

- Once the license is issued, additional time is needed to set up compliance measures.

Timely submission of documents and quick responses to NBG requests can help avoid unnecessary delays and ensure a smoother process.

sbb-itb-7fe6294

License Renewal

The National Bank of Georgia (NBG) has a structured process for renewing Forex licenses, ensuring that license holders remain compliant and operational.

Annual Renewal Timeline

Renewing your Forex license in Georgia follows a specific schedule:

| Period | Activity | Status |

|---|---|---|

| November 1 – December 1 | Standard Renewal Window | On-time filing |

| December 2 – December 31 | Grace Period | Late renewals accepted with a fee |

| After December 31 | Expiration Period | License may be cancelled |

Core Renewal Requirements

To keep a Forex license active, companies must fulfill several obligations:

- Submit annual financial reports to the NBG.

- Pay the annual license fee.

- Keep client funds in separate accounts.

- Undergo quarterly compliance checks.

- File tax reports and revenue statements.

Compliance Monitoring

The NBG ensures adherence to regulations through regular oversight:

| Monitoring Type | Frequency | Focus Areas |

|---|---|---|

| Financial Audits | Quarterly | Account segregation, capital adequacy |

| Compliance Checks | Ongoing | Operational standards, timely reporting |

| Unannounced Inspections | As needed | Risk assessment, documentation integrity |

Renewal Best Practices

To streamline the renewal process and avoid penalties, consider these strategies:

-

Proactive Management

Use a compliance calendar to track deadlines and requirements, ensuring nothing is overlooked. -

Documentation Maintenance

Organize and store all necessary records, including quarterly financial reports, client fund segregation details, compliance audits, and tax payment proofs. -

Communication Protocol

Stay in touch with the NBG to clarify any uncertainties, resolve issues quickly, and respond to audit inquiries.

Ignoring these steps can lead to serious repercussions, including license revocation.

Penalties and Compliance

Failing to comply with renewal and operational standards can result in:

- Immediate fines and suspension of trading activities.

- Repayment of profits earned during unlicensed periods.

-

License revocation for reasons such as:

- Non-payment of state fees.

- Service suspension for more than six months.

- Major compliance breaches.

- Failure to segregate client funds.

If your license expires, contact the NBG promptly to explore renewal options and avoid further complications.

Regulations

The National Bank of Georgia (NBG) plays a central role in regulating forex trading activities in the country, ensuring transparency and accountability in the financial markets.

Legal Framework

The NBG enforces forex trading rules through several legislative tools, each addressing specific aspects of the industry:

| Legislative Component | Focus Areas |

|---|---|

| Securities Market Law | Ensures fair trading practices and market integrity |

| Licenses and Permits Law | Governs licensing procedures and operational standards |

| Tax Code of Georgia | Covers financial obligations and reporting requirements |

| NBG Brokerage Licensing Order | Sets technical and compliance standards |

| AML/CFT Laws | Focuses on preventing money laundering and terrorism financing |

Forex firms operating in Georgia must meet strict requirements, including maintaining a minimum capital of 500,000 GEL, having a local office staffed with qualified professionals, conducting independent financial audits, and submitting regular reports to the Financial Monitoring Service. For a detailed breakdown of these requirements, refer to the License Requirements section.

These regulations provide a solid foundation for maintaining market discipline and protecting stakeholders.

Compliance Penalties

The NBG enforces its regulatory framework through penalties that correspond to the severity of violations:

| Violation Level | Example | Penalty Range |

|---|---|---|

| Minor | Incomplete client records | 3,000 – 7,000 GEL |

| Moderate | Failures in AML/CFT software | 7,000 – 10,000 GEL |

| Severe | Repeated compliance breaches | License revocation |

Recent cases illustrate the NBG's strict approach to enforcement:

- A currency exchange operator was fined 7,000 GEL for failing to record client data using the required software.

- An operator received multiple fines totaling 4,000 GEL for serving clients without proper verification.

- A company faced a 10,000 GEL fine for AML/CFT software failures, including missing suspicious transactions and sanctioned individuals.

The NBG employs a range of methods to monitor compliance, including scheduled and surprise inspections, remote monitoring, financial audits, risk assessments, and investigating customer complaints.

If violations are identified, firms are given a 30-day period during which the NBG determines whether to revoke their license. This decision considers factors such as the severity and frequency of violations, the company’s compliance history, corrective measures taken, and the potential impact on market stability and consumer protection.

To operate successfully in Georgia’s forex market, companies must maintain thorough documentation and implement strong internal controls to meet regulatory expectations.

Summary

The Georgia Forex license, issued by the National Bank of Georgia (NBG), offers forex operators access to international markets under a regulatory framework designed to encourage business growth. Introduced on April 11, 2018, this licensing system strikes a balance between strict oversight and a supportive environment for expansion.

Here are some key operational details:

| Aspect | Details |

|---|---|

| Capital Requirements | 500,000 GEL (varies depending on the zone) |

| Processing Timeline | Standard review completed within 30 days |

| Market Access | Access to a market of 3.7 million traders |

| Operational Framework | Includes compliance checks, audits, and reporting |

To maintain market stability, the NBG enforces regular compliance checks, conducts unannounced audits, and requires transparent reporting. These measures not only ensure a disciplined market but also create conditions that support long-term growth for licensed operators.

Forex companies operating in Georgia are required to implement stringent internal controls. This includes adhering to anti-money laundering (AML) protocols and maintaining consistent financial reporting. The NBG’s enforcement strategy is designed to promote market growth while holding operators accountable. Serious violations can result in penalties, including the suspension or cancellation of licenses.

Georgia’s combination of supportive regulations, strategic location, and modern infrastructure makes it an attractive hub for forex businesses. For companies looking for manageable capital requirements and straightforward market access, the country offers a compelling option for efficient and sustainable operations.